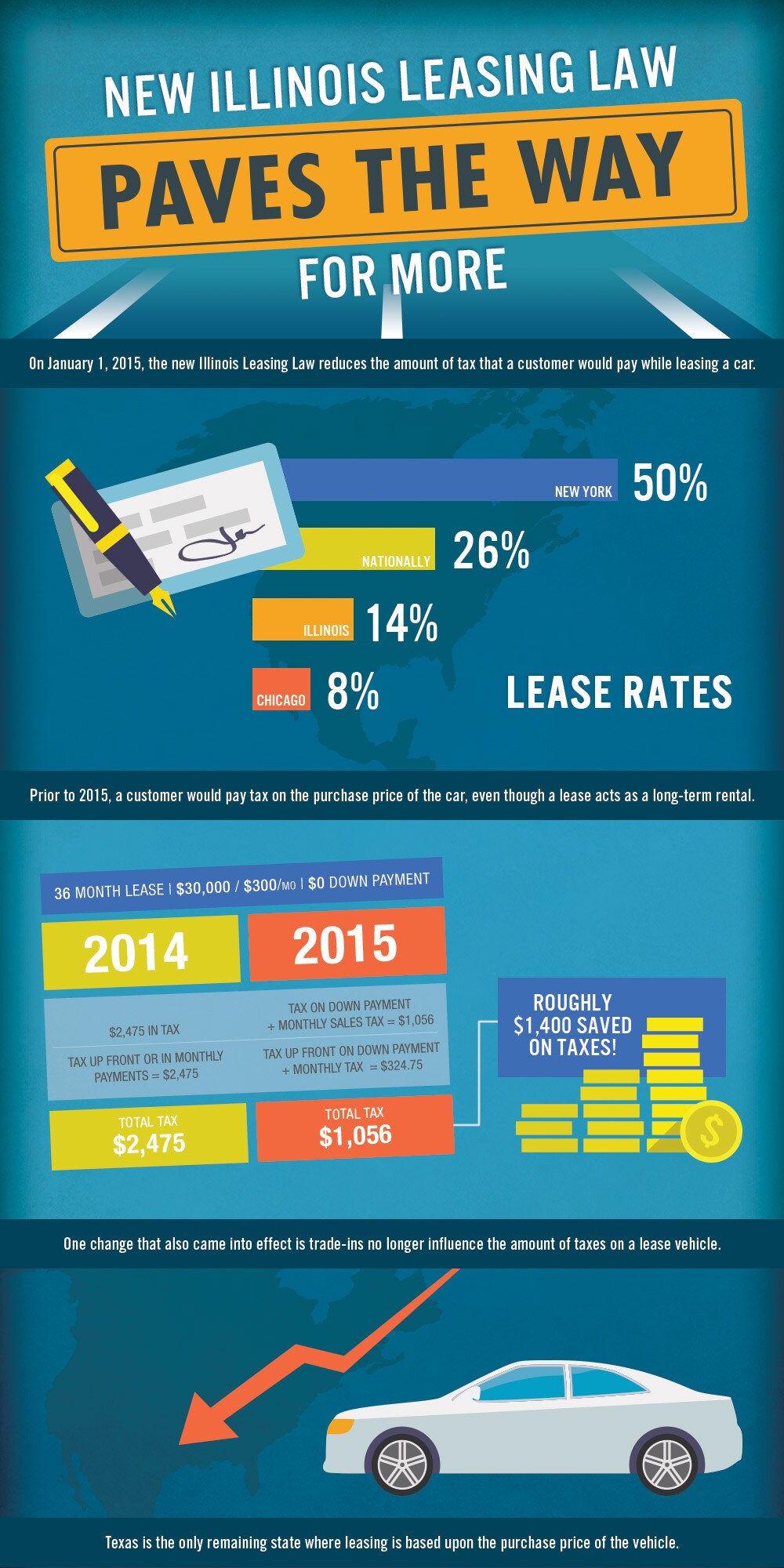

In 2015, Illinois made a significant change in exactly how automobile leasing is taxed, making it a much more attractive option for consumers. Prior to this adjustment, renting an automobile was typically much less appealing due to the high taxes put on the purchase price of the car. Customers paid tax on the complete value of the automobile, although a lease was more like a long-term rental. Under the brand-new Illinois Leasing Legislation, tax obligations are now only used to the down payment and the regular monthly repayments, which dramatically minimizes the total tax obligation burden. As an example, a client leasing a cars and truck for $30,000 saw a tax obligation savings of around $1,400 in 2015, compared to the previous system. This reform brought Illinois extra in line with other states, where leasing is already tired more positively.

The law's changes extend beyond simply tax obligation savings. With the 2015 regulation, trade-ins no longer impact the tax obligation estimation for leased cars. Illinois' brand-new regulation brings the state more detailed to nationwide criteria, and its impacts are really felt by anyone taking into consideration renting an automobile, offering substantial tax obligation cost savings and streamlining the leasing procedure for consumers across the state.

Check for more info at Bill Walsh Kia Facebook Twitter

Latest Posts

Enhance Your Kia with Genuine Accessories from Costs Walsh Kia

Why Logan Square Auto Repair is Your Go-To Shop in Chicago?

Understanding Auto Loan Terms: A Beginner’s Guide to Car Financing at Sierra Motors

Navigation

Latest Posts

Enhance Your Kia with Genuine Accessories from Costs Walsh Kia

Why Logan Square Auto Repair is Your Go-To Shop in Chicago?

Understanding Auto Loan Terms: A Beginner’s Guide to Car Financing at Sierra Motors